8 13 21 Ema Strategy

Vijaykumar Bhagat July 13, 19.

8 13 21 ema strategy. Since I did not find the official name for this strategy, I thought that due to the indicators used I will call it EMA 8/. 5 ema & 8 ema. Read on to learn more about this innovative strategy.

Used mostly in the lower time frame - 1. It is not an investment recommendation. You need the 5 and & 8 exponential moving averages.

Prove the filter does not adversely affect the process stream. The 5 EMA and 8 EMA trading strategy can be applied to any market of your choice. Simply put you only use one indicator/moving average.

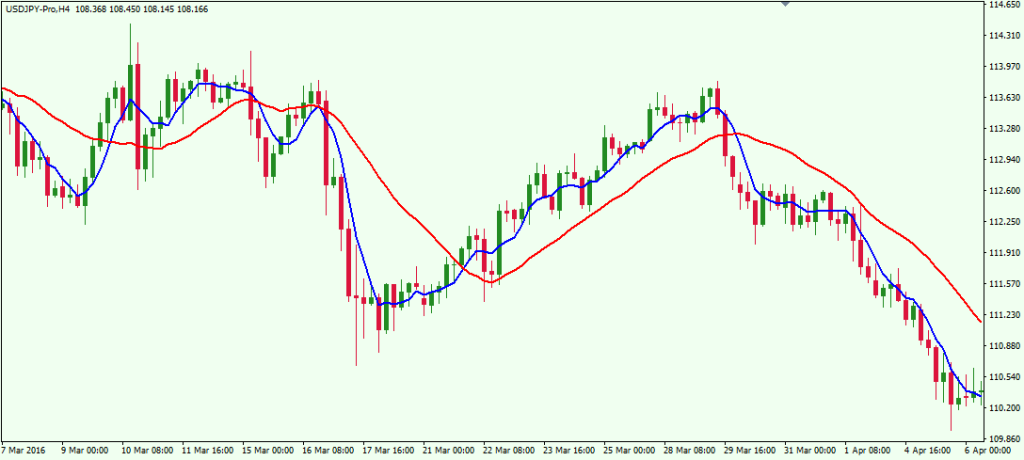

Since professional and institutional traders often use Fibonacci numbers moving average crosses, it ends up acting as a self-fulfilling prophecy as well. So you are using an 8-21 EMA cross as well as a 5-13 EMA cross. This trading strategy is simple as using regular moving averages.

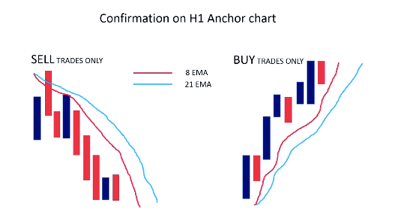

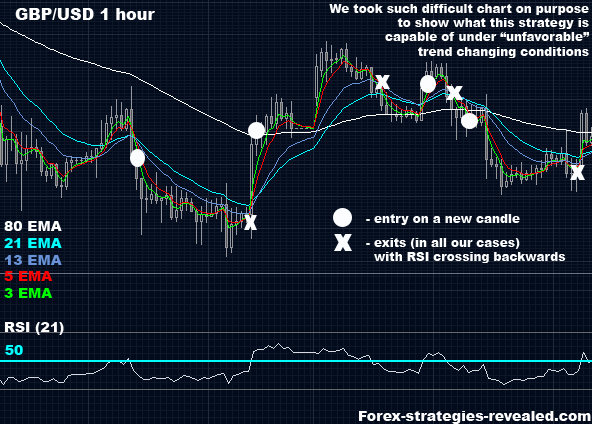

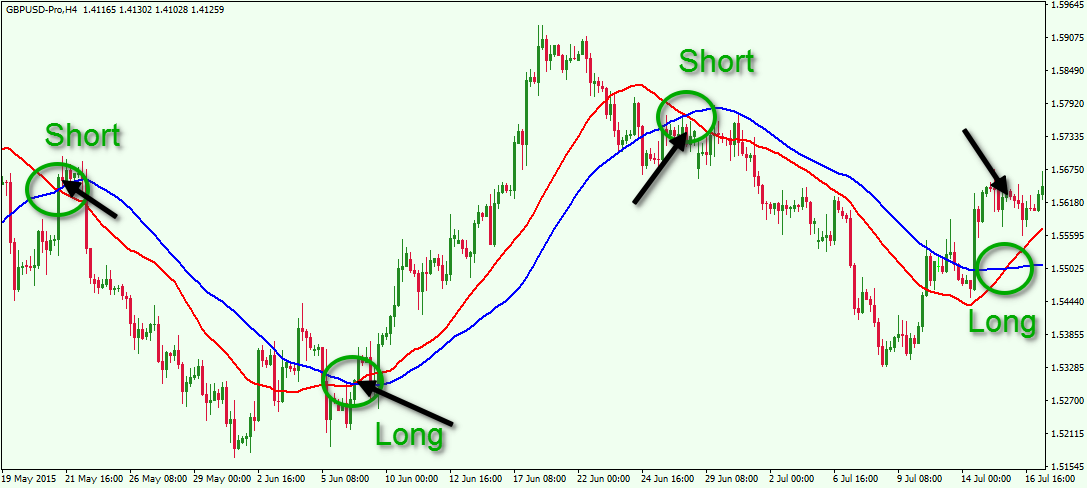

First market price needs to cross 21 EMA from upper to lower. Timing is the key, at times then we select a candle of less time period with so many average lin. If the 5 EMA (red) crosses the 8 EMA (blue) and the 13 EMA (magenta) upwards and they tend to form an intersection, it indicates that price is about to take an upward spin.

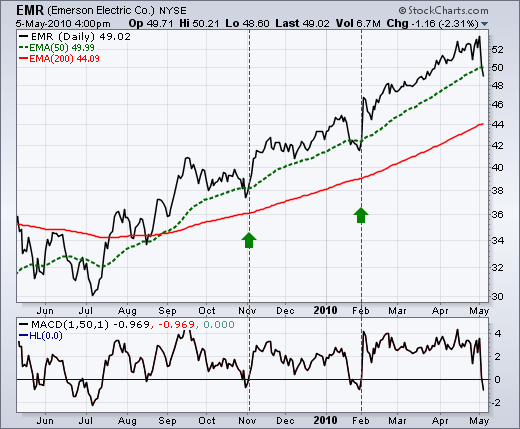

A 135% Profit In Sea With The 21-Day EMA Sea Limited ( SE ), a global platform for video games, is a great example of how using the 21-day EMA can help you capitalize on a huge move. In figure 3, we have applied two Fibonacci sequence numbers, 13 and 21, as two Exponential Moving Averages (EMAs) on the chart. Ema sell - Ema buy - Buy day ema - Ha ema co bullish - Ha ema co bullish;.

Hello, I haven’t tested it as this would give too many signals I believe, intraday is all about minute observation and deep knowledge of price action. There is nothing easy about trading but that does not mean you can’t have a simple trading strategy for Forex, Futures, Stocks, or any market and one that works if you follow the rules. And the 21 day moving average will be in red.

Next, let the RSI and Stoch. Then on M5 in same direction we need pending stop orders in the trend direction of H1. This trading strategy uses combination of the Ichimoku Kinko Hyo system with Fibonacci numbers based 13/21 exponential moving average ( EMA ) crossover, giving excellent results in trending assets !It's called a 5, 13, 62 strategy.

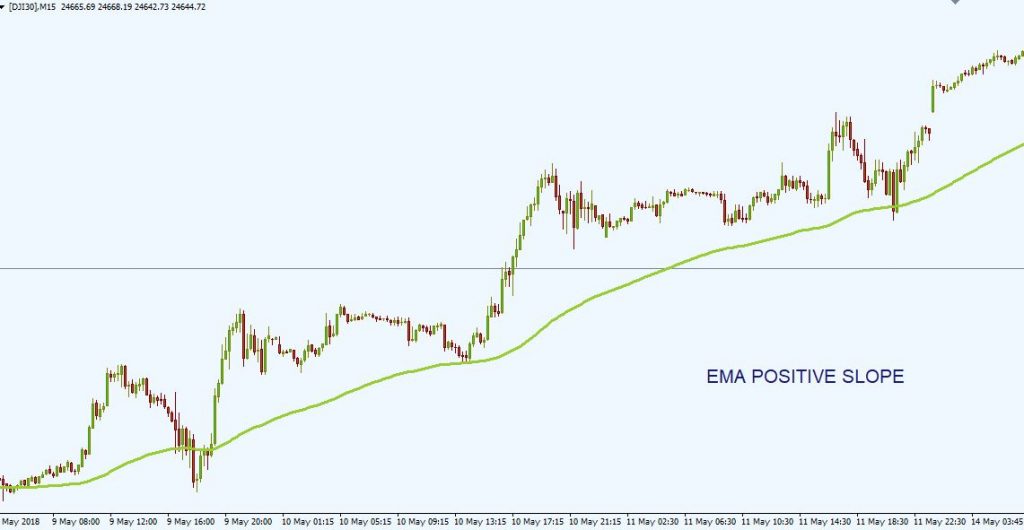

An exponential moving average gives recent prices a bigger weight, so it does a better job of measuring recent momentum. I use exponential moving averages of 8, 13, 21, and 55. The basic 5, 13, 62 EMA strategy is a multiple moving average crossover system.

Simple 5 EMA And 12 EMA With 21 RSI Forex Trading Strategy Never be mislead by the terms “simple Forex trading strategy” thinking that it means easy. Use Fibonacci Trendlines (8, 13, 21, 55) In a bull market. The general strategy is that when all the moving averages cross each other, it is time to go LONG with the 55 moving average staying BELOW.

You can get efficient results using at least 4 hours chart. The difference in this strategy w.r.t the EMA crossover technique discussed earlier is that here there are 3 characters instead of two. I use a 55 and 21 EMA, and when they cross i buy/sell.

Need help and suggestions. Your use is at your own risk. This is super simple trading strategy and it takes effort before you are able to use it properly.

It is not recommended for short-term investments. A MACD(5,13,1) crossing zero is the exact same as a EMA 5 and EMA 13 crossing. 3 EMAs will help identify and predict uptrends and downtrends -If EMAs are all above the candles it a sign to sell & if the EMAs are below its a sign to buy - If the Green-8 EMA crosses or touches red candle then flips under the other EMAs & candles then it's time to sell -If the Green-8 EMA crosses or touches green candle then flips above the other EMAs & candles then it's time to buy - how.

If i reduce the 55 and 21 it will slightly speed it up. Going forward in this article, we will only use exponential moving averages. The 3-period and 8-period exponential moving average crossover is a variation of the traditional moving average crossover strategy.

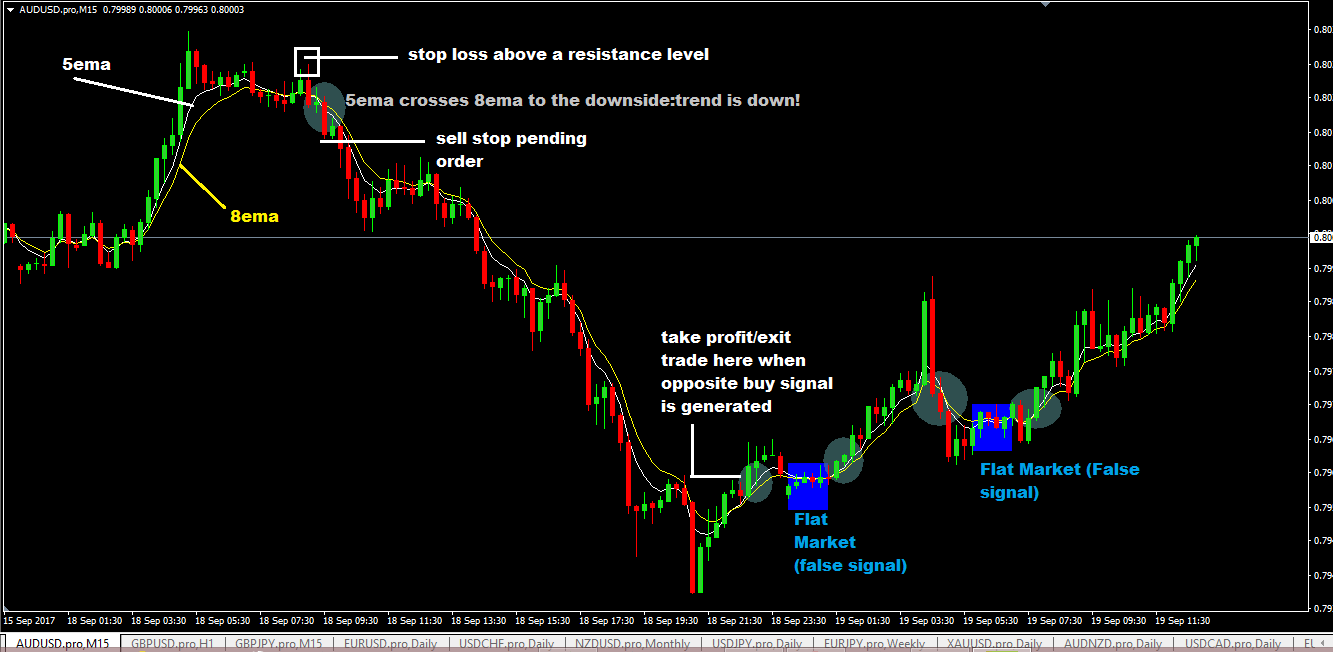

However it will be more volatile to false signals i assume, so is there anything better i can use to show changes in trend. Wait for 5 ema to cross 8 ema to the upside. 50 days ema/sma below 0 days ema/sma;.

EMA Crossover Trading Strategy. Previously tested EMA Rainbow strategy was based on 3 moving average and its results were very satisfactory. With this forex trading strategy, you don’t need to do a lot of technical analysis because it would probably take just a 5 seconds scan of your forex charts to see if you can trade or not, that’s how simple it is.

21 EMA with the 5M chart. 3 ema 8 ema crossover binary options Ema 6 And Ema 14 Binary Options Strategy Indicator. However, there are some subtle differences with this type of a trading strategy.

The strategy is simple, we take 2 exponential moving averages, one with a shorter period and the other with a longer period and we track the signals when a crossover occurs. Buy/sell when the candle closes above/below the moving average. Seems to match up with the EURUSD volatility.

The 10 and 21 EMA Crossover is a simple moving average crossover strategy. As you may have guessed, this strategy will be based on two exponential moving average (EMA):. In one graph, 4 different periods include EMA (8/13/21/55).

There are three moving averages on the 5-minute chart;. Square off when it cuts EMA 8. 5, 8, and 13 period simple moving averages offer perfect inputs for day traders seeking an edge in trading the market from both the long and short sides.

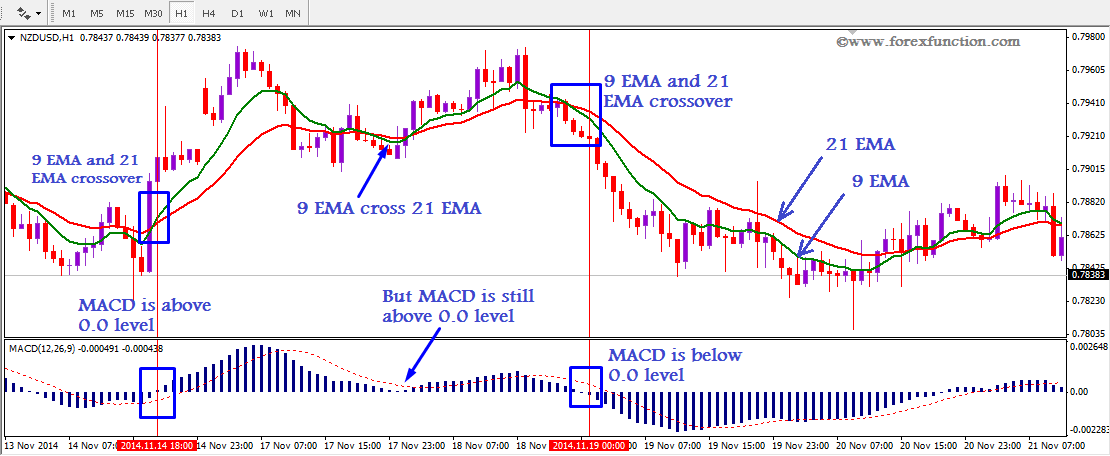

When value of the 21 EMA is in the MIDDLE of EMA 9 AND EMA 55 AND EMA 9 IS CROSSING DOWN 21 FROM ABOVE 21 TO BELOW EMA 21. At the same time, if MACD stay below 0.0 level, then open sell entry. Keep in mind this is a short term swing trading strategy so keep your profit expectations in check.

Using the 8 / 21 EMA's almost like the MACD, to indicate trend momentum. While you can use any moving average, be it the combination of 5 and 10, or 15 and 30, the best crosses are always based on the Fibonacci sequences such as 5, 8, 13, 21… etc. The trend is a downtrend when the 5 EMA crosses downward the 8 EMA.

As you can see, once the EMA 13 crossed above the EMA 21, it confirmed the bullish trend, and as the bullish momentum accelerated, the distance between EMA 13 and EMA 21 widened. Plot a 9 and period EMA on your chart. The point is that there are many ways that you can profit from the EMA crossover strategy, and the great thing is that you only really need to use two simple technical indicators.

The principle of this strategy is when the 5 EMA will cross upward the 8 EMA, then the direction of the trend is an uptrend. Trade breakout with 5 EMA, 10 EMA, 14 EMA, 21 EMA, 50 EMA Whenever the 5, 10, 14, and 21 or 50 EMA’s form a narrow path on the chart they are in a range or in consolidation, i.e. Swing Trade Advanced 55 EMA Strategy This strategy is specific for a 3 hr, 4 hr, or a 6 hour chart.

8 and 21, allowing to determine the trend and level of entry for transaction. If the exponential moving average strategy works on any type of market, they work for any time frame. They are excellent mentoring.

Use 12:6 for take profit :. Buy at the close of the candlestick that closes after the ema’s have crossed. It would cause you to do more trades though.

It would allow you time to spend on managing the important tasks in your business and less time managing your mundane tasks. I have a strategy of EMA 8 and 13 Crossover on 10 min chart which (on an avg) gives 1 OR 2 trades a day i. You can use this forex strategy for any currency pairs.

Any suggestions see attached sorry the moving average disappeared from the gif file. 1) EMA 34 line 2) EMA 8 line 3) Priceline EMA 34 is effectively 1 month weighted average EMA 8 is effectively 1 week weighted average A) When price cuts EMA 34 from below, Buy. Wait for 5ema to cross 8ema to the upside.

The 8 day moving average will be shown in magenta. An exponential moving average (EMA) is a type of moving average that places a greater weight and significance on the most recent data points. This is applicable to any currency pairs.

Orchid-consolidation - Consolidation using ema(5,13,26) Good stocks for jeevan - Observe price crossing above ema or sma for the last 8/9 days. The EMA’s overlap each other without going either up or down. Now in action what we have to do.

Just plot it on your charts. If need be, you could also make use of this trading strategy on intraday chart time frame as well. September 19, 19 at 7:13 pm.

Time frame M5 and H1. 5 EMA And 8 EMA Trading Strategy Details. Some of the most commonly used moving averages are the 10-day simple moving average (10 SMA), the SMA, the 50 SMA, and the 0 SMA, but there are many others (21 EMA, 34 EMA, 72 EMA, 100 SMA, to name a few.

Watch for this setup on your own to get a better idea of how the strategy works, but keep in mind that no strategy works 100 percent of the time;. Traders use many different moving averages as support and resistance. I also use a MACD with settings 5, 50, 10.

More Moving Average (MA) Definition. Strategy #1 – Real-Life Example going with the primary trend using the SMA. I just use the laws of nature:.

Open the position when EMA5 has crossed EMA13. I appreciate your generosity to educate the traders by your so many mails and videos. Trade entries are taken after the ema cross-over;.

A crossover between 2 moving average is probably one of the most well-known technical analysis signal used by traders. The 8 EMA, the 13 EMA, and the 21 EMA. Satya strong steady safe scan - 26 (sssss-26) germinating seedlings - Germinating seedlings.

Above, you can see the daily chart set up that I use for the 3-EMA and the 8-EMA crossovers. 8 EMA workshop 22-23 March 12 EMA Geriatric Medicines Strategy –Key points (2) “. 0%, and even +156.

As you can see, in the far left, when the green line moved above the red line, the price soon gained bullish momentum and started to move up. Place a buy order when the following chart rules or conditions are in display:. Hello All, I’m testing this method/system or whatever you want to call it.

21 , 13 ,8 EMA. This system uses a 4-hour and daily timeframe. You might try a close below the 7 EMA as an exit strategy.

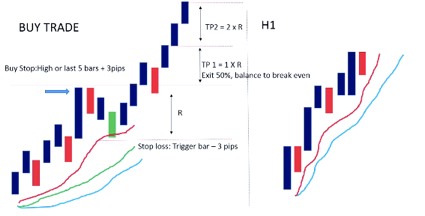

8 / 21 EMA Strategy. Over the past two weeks, I have published partly statistics showing the …. Analyzing the BUY trade on a 5-minute chart.

Say, we have confirmed a BUY trade on the H1 chart, and have a nicely laid out 5-minute chart. The 21 RSI With 5 EMA And 12 EMA Forex Trading Strategy is a very simple forex trading strategy that beginner forex traders as well as advanced forex traders can find useful. The formula for the exponential moving average is more complicated as the simple only considers the last number of closing prices across a specified range.

What should be the nature of the trade ?. 5 EMA must cross the 8 EMA in an upward direction. When 21 EMA downside breakout complete, then look at MACD indicator.

The main thing is that you have a good understanding of how this short term trading strategy using two moving averages work. #FreeTipsChannelLinkInDescriptionAndFreeMT4DataFeed Join below FREE Telegram Channel for MCX, Cash, Future, Index, Options and. The Exponential Moving Average EMA Strategy is a universal trading strategy that works in all markets.

Thank you for taking the time to write and share it. So you might as well just use the EMA 8-21 and the RSI unless you think the MACD is giving you something else. I have found them ti be educative.

I use a 150 EMA for trend. For trade exit the reverse crossover of those EMA's occasionally causes you to lose many of the pips of profit when the reversal/pullback is at a shallow angle. My EMA cross however comes about 5 candles and 25 pips too late.

This includes stocks, indices, Forex, currencies, and the crypto-currencies market, like the virtual currency Bitcoin. The EMA 12 and EMA 26 trading strategy combines two different exponential moving averages. EMA 12 And EMA 26 trading strategy explained.

I take all the other moving averages and the candles off the chart. But, the crossover of the 7 EMA and 14 EMA shows promise for trade entry. When there is confirmation, however, the 3- & 8- crossover is a.

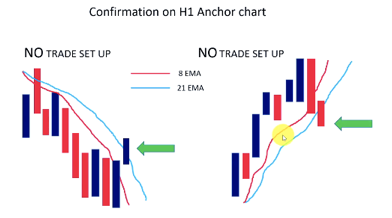

Been working with this for several weeks, seems to reduce the fakeouts. First place all the EMA on your chart then you will see three EMA just we need to check confirmation from H1 chart of trend direction. The epiphany came when I started using the 3 EMA and 8 EMA crossover points as indicators to trade into and out of positions with the Vector Vest program.

This strategy was based on two exponential moving averages (EMA):. Not sure how to place take profits or SL’s. I take from Fibonacci sequence numbers 5 and 13 as the parameters for moving averages.When you wish to determine the price movement, the time for opening and closing the positions, use Exponential Moving Average (Exponential moving average) 5 and 13 indicators and follow these rules:1.

The Exponential Moving Average EMA Strategy is a universal trading strategy that works in all markets. As price moves on, we look out for a trigger. If the the 5 ema is below the 8 ema, we will look for short trades.

Ema Blue Green Yellow Red Strategy Indicator By Heffjobbs9 Tradingview

Exponential Moving Average 5 Simple Trading Strategies Infographic

1 Min Scalping With 34 Exponential Moving Average Channel Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

8 13 21 Ema Strategy のギャラリー

5 Ema And 8 Ema Crossover Swing Trading System

The Ultimate Guide To Moving Averages Trend Analysis The Pro S Way T3 Live

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Exponential Moving Average 5 Simple Trading Strategies Infographic

Golden Cross Trading 5 Best Golden Cross Strategies Trading In Depth

A 5 Step Scalping Strategy Forexsignals Com Blog

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Secrets Of Trend Analysis The Power Of The 8 21 Day Moving Averages T3 Live

Moving Average Strategies For Forex Trading

Simple Rsi Ema High Profitable Ratio Strategy Forex Factory

0 Day Moving Average What It Is And How It Works

A 5 Step Scalping Strategy Forexsignals Com Blog

5 8 13 Forex Scalping Trading Strategy

5 Ema And 13 Ema Fibonacci Numbers Trading System Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

5ema And 8ema Forex Trading Strategy Ema Forex Strategy

The Moving Average Strategy Guide For Trading In

1

Price Action Indicator Wanted Forex Factory

How To Trade With The Exponential Moving Average Strategy

Complex Trading System 4 Trend Trading With Emas Forex Strategies Systems Revealed

How To Trade With The Exponential Moving Average Strategy

Page 5 Multiples Indicators And Signals Tradingview India

Trading Strategy Of Ema Crossover With Macd

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

8 13 21 Ema Indicator By Aspectdnb Tradingview

5 Ema And 13 Ema Fibonacci Numbers Trading System Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

A 5 Step Scalping Strategy Forexsignals Com Blog

Exponential Moving Average 5 Simple Trading Strategies Infographic

Golden Cross Trading 5 Best Golden Cross Strategies Trading In Depth

Moving Averages Simple And Exponential Chartschool

:max_bytes(150000):strip_icc()/dotdash_Final_The_Perfect_Moving_Averages_for_Day_Trading_Sep_2020-02-b64a1ea406794bb38847ecbdd5b6e2e2.jpg)

The Perfect Moving Averages For Day Trading

Exponential Moving Average Definition Day Trading Terminology Warrior Trading

Moving Average Strategy Guide 5 Moving Average Strategies

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

How To Trade With The Exponential Moving Average Strategy

Moving Averages Varsity By Zerodha

6 Killer Combinations For Trading Strategies Fx Leaders

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

4ema 8 13 21 55 Death Cross 100 0 Bollinger Bands Indicateur Par Alessiof Tradingview

Anatomy Of Popular Moving Averages In Forex Forex Training Group

:max_bytes(150000):strip_icc()/professional-profession-chart-font-diagram-multimedia-1163690-pxhere.com1-f9ca2bfa361044e9a3d6292b691e3835.jpg)

Most Commonly Used Periods In Creating Moving Average Ma Lines

:max_bytes(150000):strip_icc()/dotdash_Final_The_Perfect_Moving_Averages_for_Day_Trading_Sep_2020-03-39f95b50cdd947d48a8b28ed34e2d8f0.jpg)

The Perfect Moving Averages For Day Trading

The Ultimate Guide To Moving Averages Trend Analysis The Pro S Way T3 Live

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Moving Average Strategy Guide 5 Moving Average Strategies

Gold Ema Alignment Strategy Fx Vix Traders Blog

5 8 13 Forex Scalping Trading Strategy

8 Ema 5 Ema Trading Strategy

Exponential Moving Average 5 Simple Trading Strategies Infographic

3ma Indicators And Signals Tradingview

1

Moving Average Strategy Guide 5 Moving Average Strategies

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Q Tbn 3aand9gcsjpexkqngnq Qcokhsfskpj36abcmrxwswuebp0 Mmy Kantlw Usqp Cau

1

Top 3 Simple Moving Average Trading Strategies

Perutrading Indicators And Signals Tradingview

Ema 21 13 8 Scalping Indicator By Odalhousani Tradingview

Which Moving Average Works Best For Intraday Trading In Stocks Quora

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Etoro S Guide To Technical Analysis Tools Trader S Lingo

0 Day Moving Average What It Is And How It Works

How To Use Moving Averages Moving Average Trading 101

Ema Strategy 8 13 21

How To Trade With The Exponential Moving Average Strategy

21 Rsi With 5ema And 12 Ema Forex Trading Strategy

Tradingview Tutorial How To Trade Like A Pro Youtube

Tradingfibonacci Com Combining Fibonacci With Major Technical Analysis Tools

Moving Averages Part 2 Financial Markets Economies

8 Indicators And Signals Tradingview

Which Moving Average Works Best For Intraday Trading In Stocks Quora

8 Indicateurs Et Signaux Tradingview

Revealed Secrets Of Moving Averages Bullbull

Moving Averages Varsity By Zerodha

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Anatomy Of Popular Moving Averages In Forex Forex Training Group

How To Use Best Moving Averages Forex Trading Strategies Youtube

Stockdweebs My Million Dollar Strategy Indicators 1 13 21 55 Ema 2 0 Ma 3 When 0 Ma Crosses Under 12 21 55 Ema Bullish Trade Setup 1 Only Uptrend

Moving Average Strategy Guide 5 Moving Average Strategies

Ema Strategy 8 13 21 By Viniciuszampirolicerqueira Tradingview India

Guide To Trading Using The Ema Indicator On Iq Option Iq Option Wiki

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Philakone Ema 8 13 21 55

325 Million New Users Bitcoin Today June 24th By Try Can Do Medium

Moving Average Strategy Guide 5 Moving Average Strategies

Anatomy Of Popular Moving Averages In Forex Forex Training Group

Which Moving Average Works Best For Intraday Trading In Stocks Quora

Exponential Moving Average 5 Simple Trading Strategies Infographic

Exponential Moving Average 5 Simple Trading Strategies Infographic

/dotdash_Final_Strategies_Applications_Behind_The_50_Day_EMA_INTC_AAPL_Jul_2020-01-0c5fd4e9cb8b49ec9f48cb37d116adfd.jpg)

Strategies Applications Behind The 50 Day Ema Intc pl

5 Ema And 13 Ema Fibonacci Numbers Trading System Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

Golden Cross Trading 5 Best Golden Cross Strategies Trading In Depth

Exponential Moving Average 5 Simple Trading Strategies Infographic

A Zero To A Million Trading Strategy Trading Strategy Guides

0 Day Moving Average What It Is And How It Works

Best Moving Averages This Is What Professionals Use For Forex Stock Trading Youtube

Moving Average Strategy Guide 5 Moving Average Strategies

Which Moving Average Works Best For Intraday Trading In Stocks Quora

Multiple Ema 8 13 21 55 By Melihguler Indicador Por Melihguler Tradingview

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset